Nepal Visit Updates

Vibrant Nepal – The Land of Himalayas

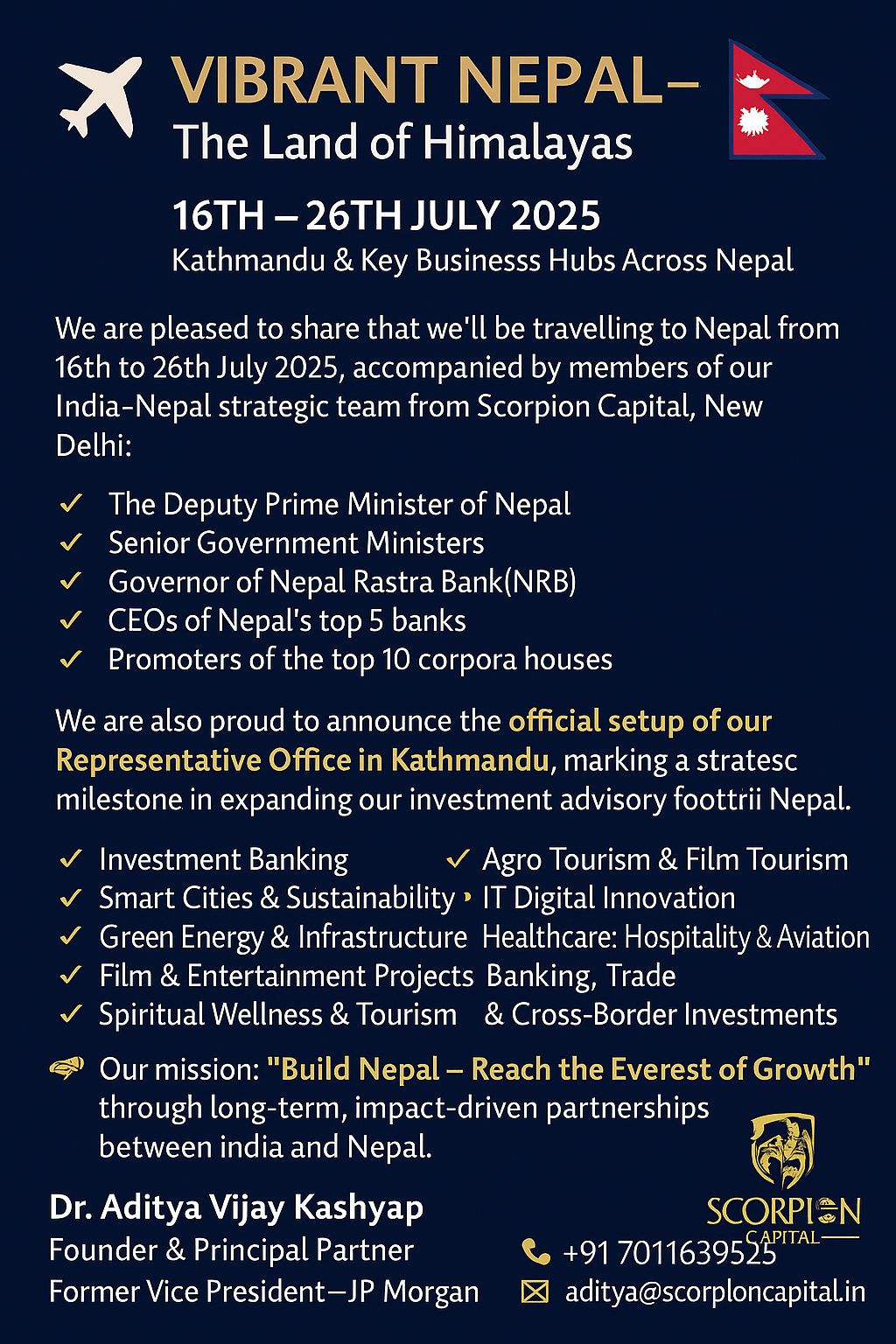

Scorpion Capital is proud to expand its strategic footprint in Nepal through our official business visit from 16th–26th July 2025, engaging with the nation’s top leaders, financial institutions, and corporates — driving investment, innovation, and sustainable growth.

This visit will also feature exclusive roadshows, meet & greet events, and MoU signings across key cities to foster strategic partnerships in Nepal’s high-potential sectors.

Let’s Build Nepal – Reach the Everest of Growth.

Team Scorpion Capital – Nepal Visit Update 🇳🇵 (Day 10)

Vibrant Invest Nepal 2025 – Day 10 Update 📍 Kathmandu | July 25, 2025

From the desk of Dr. Aditya Vijay Kashyap, Founder & Principal Partner, Scorpion Capital, New Delhi

🔷 Key Milestone Achieved:

✅ Official Inauguration of Chief Representative Office in Kathmandu, Nepal Team Scorpion Capital proudly inaugurated its Chief Representative Office in Kathmandu, marking a historic and strategic step towards deepening Indo-Nepal investment cooperation. This permanent establishment will serve as the central hub for cross-border funding, advisory, and project facilitation between India, Nepal, and global markets.

🔷 High-Level Engagement with Nepal Rastra Bank:

🟢 A special meeting was held with the Hon’ble Governor of Nepal Rastra Bank, where the following key topics were discussed:

- Policy framework and facilitation for ECB (External Commercial Borrowing) and FDI into Nepal

- Investment opportunities in strategic sectors

- Mining & Iron Ore

- Film & Entertainment Infrastructure

- Smart Cities Development

- Hydropower & Renewable Energy

- Healthcare & Medical Tourism

- Hospitality & Tourism Infrastructure

- Banking & Financial Sector

- Proposal to set up the Chief Representative Office of Nabil Bank in India, with Scorpion Capital offering full facilitation and strategic advisory.

The meeting concluded on a highly positive note. The Governor welcomed the initiatives of Scorpion Capital and assured full institutional support in all future collaborations.

✨ This marks a new era of bilateral cooperation and economic transformation through structured capital flows, strategic investment, and institutional partnerships.

Team Scorpion Capital – Nepal Visit Update 🇳🇵 (Day 9)

Scorpion Capital – Nepal Mission

📍 Kathmandu | Day 9 Update – 25 July 2025

From the Desk of Dr. Aditya Vijay Kashyap Founder & Principal Partner, Scorpion Capital, New Delhi

🔶 Strategic Engagements on Day 9

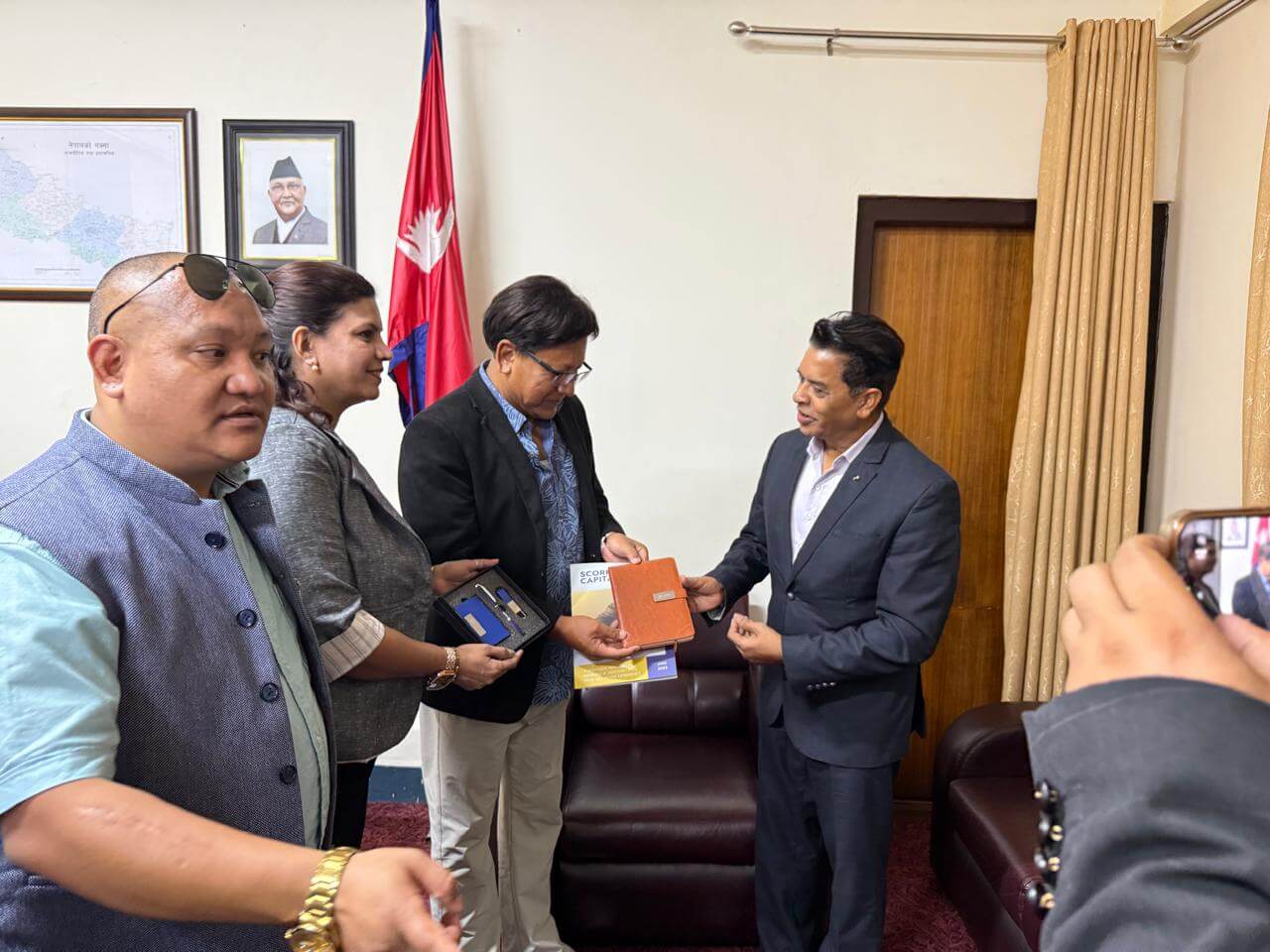

✅ 1. Key Meeting with NABIL Bank – Deputy CEO & Head of Treasury Scorpion Capital held a high-level discussion with the Deputy CEO and Head of Treasury of NABIL Bank, Nepal’s leading private sector bank. The core agenda revolved around establishing a Representative Office of NABIL Bank in India, with Scorpion Capital acting as its official representative in the region.

🧭 Focus Areas:

- Cross-border Trade Finance

- Structured Remittances Channels

- Bilateral Banking & Treasury Coordination

- Strategic Financial Infrastructure between India & Nepal

This strategic collaboration aims to enhance Indo-Nepal economic corridors with efficient banking and capital solutions.

✅ 2. Investment Discussion with Seti Krishi Farm House (Pokhara) Met with the CEO of Seti Krishi Farm House to discuss a proposed investment of ₹100 Crores for the development of:

- A state-of-the-art Agro Park

- Cold Storage & Livestock Infrastructure

- Agriculture value chain optimization in Gandaki region

Scorpion Capital is structuring this as a bankable investment model, incorporating subsidy support, equity, and long-term debt instruments.

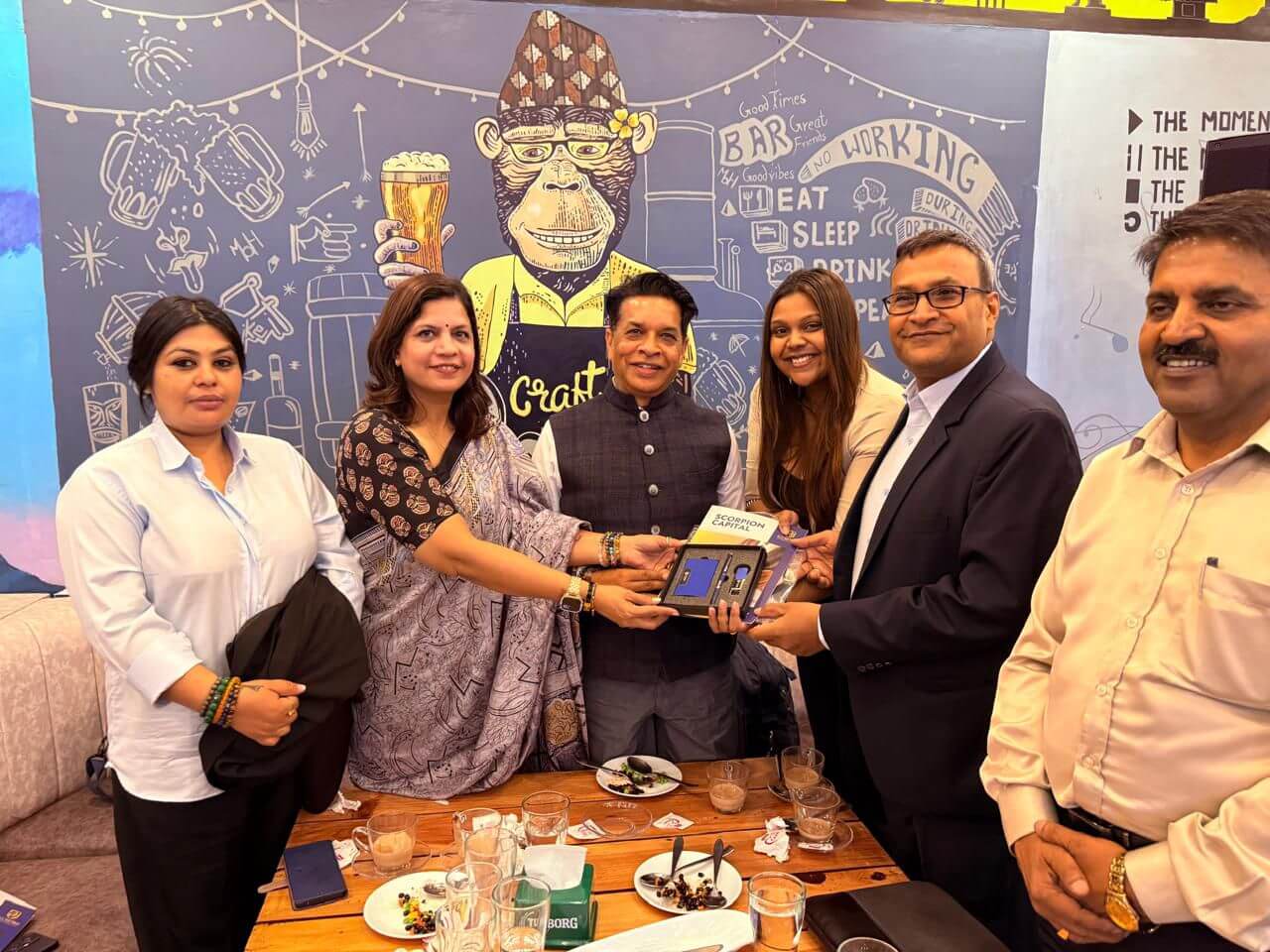

✅ 3. Final Rehearsals for “Vibrant Nepal – Meet & Greet” Grand Closing Event The day concluded with a full-team rehearsal with the India and Nepal teams for the grand finale of the Vibrant Nepal Roadshow to be held on 25th July evening at Hotel Pabera, Budhanilkantha. All speaking slots, sequences, ceremonial welcome, and hospitality logistics were finalized.

📝 Stay tuned for the closing event highlights and strategic announcements. Scorpion Capital remains committed to unlocking Nepal’s growth story through structured capital, regional partnerships, and purposeful investments.

Team Scorpion Capital – Nepal Visit Update 🇳🇵 (Day 8)

Vibrant Nepal Roadshow – Day 8 Report

From the desk of Dr. Aditya Vijay Kashyap, Founder & Principal Partner, Scorpion Capital

1. Meeting with Nepal Lab House Pvt. Ltd.

The first meeting of the day was held with Nepal Lab, focusing on strategic expansion of their diagnostic operations across Nepal. Scorpion Capital will support in structuring investment and funding mechanisms to facilitate nationwide growth in the health diagnostics sector.

2. Meeting with BL Group of Industries

The second meeting was held with the diversified BL Group. Key discussion points included:

- Revival of BL Airlines as an international carrier through a joint venture

- Launching Nepal’s largest hydropower project (USD 1.2 Billion estimated cost).

- Joint structuring of equity, EPC, and fundraising mandates led by Scorpion Capital.

3. Meeting with Nepal’s Leading Animation Company

A forward-looking joint venture was discussed between Scorpion Capital Entertainment and Nepal’s largest animation company. Plans include co-producing animated films, securing global investments, and establishing Nepal’s first Animation & Film City for digital storytelling.

Summary & Next Steps

Day 8 concluded with strong momentum in aviation, hydropower, diagnostics, and the creative economy. Scorpion Capital will now proceed with MoU structuring, investment proposals, and JV development with the respective partners.

Team Scorpion Capital – Nepal Visit Update 🇳🇵 (Day 7)

Scorpion Capital – Nepal Mission | Day 7 Update 🇳🇵

From the desk of Dr. Aditya Vijay Kashyap Founder & Principal Partner, Scorpion Capital

Another milestone day as Team Scorpion Capital engaged deeply with top government stakeholders, institutional leaders, and policy influencers to drive Nepal’s economic resurgence through global partnerships and structured investments.

✅ Key Highlights:

Mining Monetisation & Green Fund Formation

Strategic meeting held with senior officials and the CEO of Investment Board of Nepal (IBN) to present our proposals across four critical verticals:

🎬 Nepal Film City – Creation of a spiritual and sustainable entertainment smart city

🔋 Green Fund for Hydropower Projects – Proposal to mobilize global ESG capital for renewable energy

⛏️ Mining Asset Monetisation – Framework to raise capital by unlocking dormant mineral resources, including a UK-based roadshow for global investor interest

🪨 Iron Ore Mining Initiative – Structuring of a $150 million fund under a self-sustainable model to explore and operationalize iron ore assets

💧 $1 Billion Hydropower Development Fund – Formation of a dedicated investment vehicle to co-finance major hydroelectric projects across Nepal

We are committed to supporting the Government of Nepal in positioning the country as a regional investment magnet and a model for green and inclusive growth.

Team Scorpion Capital – Nepal Visit Update 🇳🇵 (Day 6)

Scorpion Capital – Nepal Mission | Day 6 Update 🇳🇵

📍 Kathmandu | July 21, 2025

From the desk of Dr. Aditya Vijay Kashyap, Founder & Principal Partner, Scorpion Capital

Another milestone day as Team Scorpion Capital actively engaged with top government stakeholders, institutional leaders, and policy influencers to accelerate Nepal’s vision of economic transformation.

✅ Key Highlights:

- Mining Monetisation & Green Fund Formation

Held strategic meetings with senior officials from:

- Department of Mining & Geology

- Ministry of Industry, Commerce & Supplies

- Ministry of Energy

Discussions focused on:

- Asset monetisation of Nepal’s rich mineral reserves

- Launch of a Green Fund with global FDI infusion

- Development of logistics parks and support infrastructure

- Policy advisory support for setting up the largest mining & energy investment fund in Nepal

2. EPF & Banking Sector Engagement

Met with:

- CEO & Administrator – Employees Provident Fund (EPF), Nepal

- Director – Himalayan Bank Limited

Agenda included:

- Structuring a Private Equity Fund for EPF investments

- Utilising Himalayan Bank as Fund Manager

- Exploring correspondent banking relationships

- Strategic tie-ups for cross-border investment mobilisation

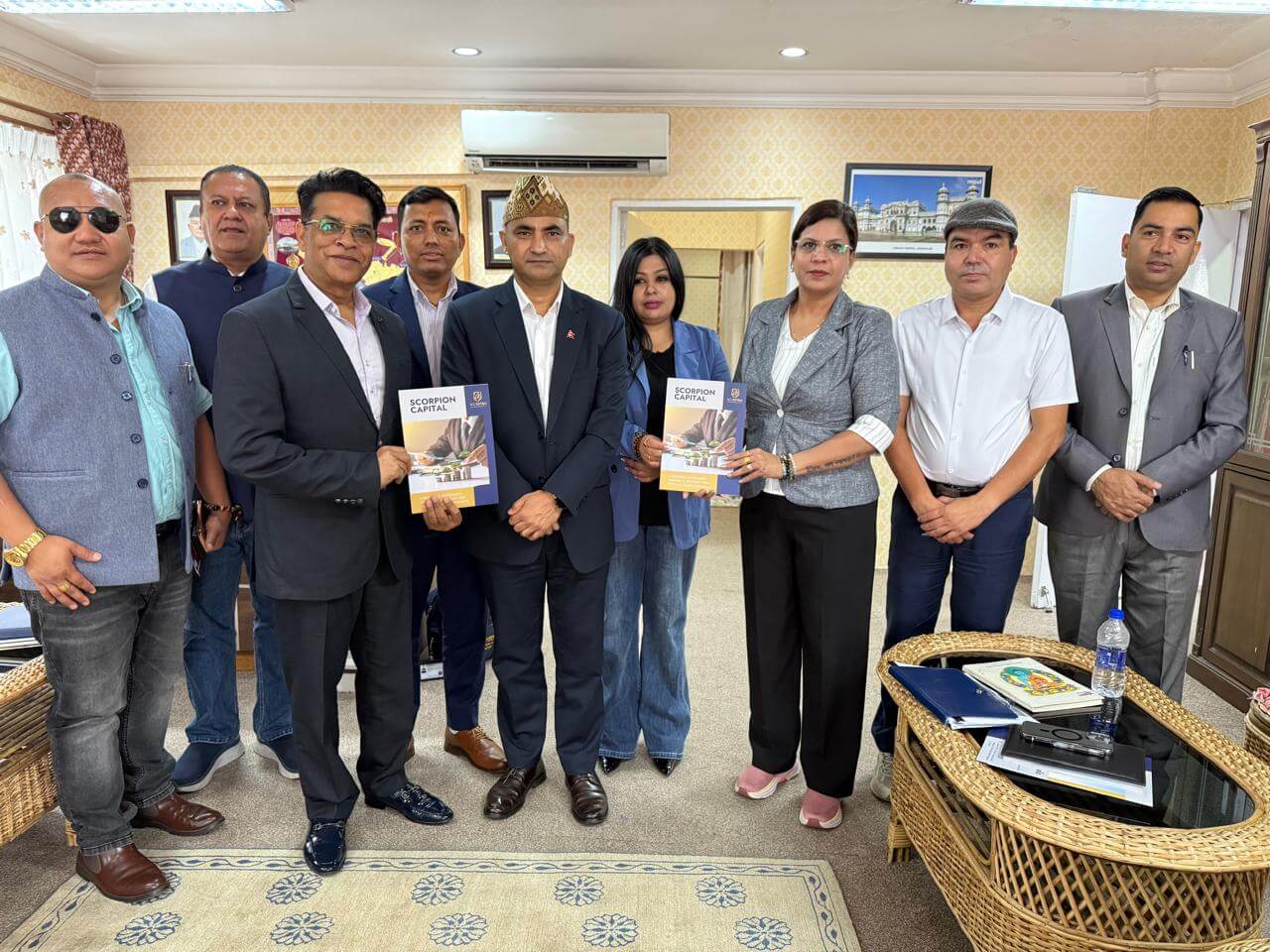

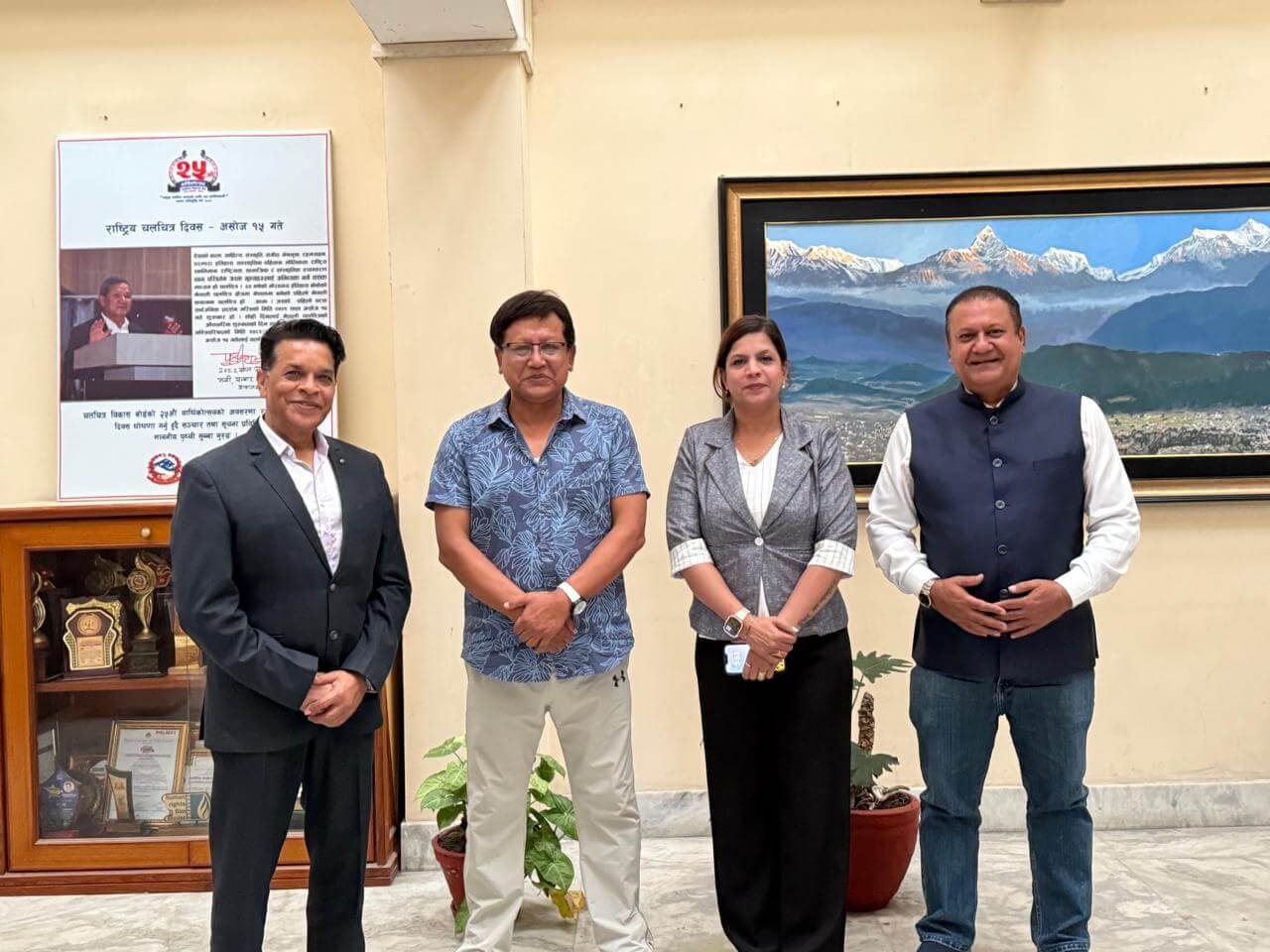

3. Film City & Entertainment Infrastructure

Engaged in high-level discussions with:

🎬 Chairman – Nepal Film Board

Vision:

To establish a world-class Film City in Nepal with government support.

Outcomes:

- Govt expressed readiness to allocate land with full approvals

- Proposal under the Single Window Clearance Scheme

- Subsidies and incentives to be provided for promoters in film, media & entertainment sectors

- Policy alignment to make Nepal a global film production destination

Scorpion Capital continues to work closely with the Government of Nepal to build next-gen investment frameworks that will drive long-term sustainable growth in key sectors such as mining, energy, banking, and entertainment.

Team Scorpion Capital – Nepal Visit Update 🇳🇵 (Day 5)

Scorpion Capital – Nepal Mission | Day 5 Update 🇳🇵

📍 Kathmandu | July 20, 2025

Another milestone day as Team Scorpion Capital engaged with key stakeholders to catalyze Nepal’s next leap in development:

✅ Mining Monetisation & Warehousing Funds – Productive discussions with Hon. Minister for Commerce, Industry, Civil Supplies & Mining on raising global green funds for warehousing, logistics parks, and mineral monetisation under Invest Nepal.

✅ Policy Dialogues – Strategic meeting with Dy. Prime Minister & Finance Minister covering FDI, ECB norms, and institutional frameworks for hosting global investor summits.

✅ Film & Entertainment – High-level interactions with Nepal Film Board for establishing a Sustainable Smart Film City – an integrated destination for production, tourism & spiritual narratives.

✅ Spiritual Collaborations – Visionary dialogue with Guru Ma, Chairman of Global Nepali Buddhist Foundation, on creating the world’s largest spiritual city (Nikko, Japan) and its Nepal counterpart, integrating film tourism & spiritual wellness.

🔋 Green Energy – Cross-border hydro grid potential & launch of Green Energy Fund

🎬 Tourism & Film – Spiritual circuits, hill resorts & destination film projects

✈️ Aviation & Skills – Aviation Academy, MRO, Pilot College & Technical Training Centre

🏨 Hospitality – Investment interest in 5-star wellness hotels & sustainable resorts

We’re committed to advancing sustainable growth, skill empowerment, and global positioning for Nepal through transformative investments & strategic partnerships.

Team Scorpion Capital – Nepal Visit Update 🇳🇵 (Day 4)

Scorpion Capital – Nepal Mission | Day 4 Update 🇳🇵

Kathmandu | July 19, 2025

Another milestone day as our team engaged with key stakeholders across:

🔋 Green Energy – Cross-border hydro grid potential & Green Energy Fund launch

🎬 Tourism & Film – Spiritual circuits, hill resorts & destination film projects

✈️ Aviation & Skills – Plans for Aviation Academy, MRO, Pilot College & Technical Training Centre

🏨 Hospitality – Investment interest in 5-star hotels & wellness infrastructure

We’re committed to advancing sustainable growth, skill development, and global positioning for Nepal through strategic investments and partnerships.

Team Scorpion Capital – Nepal Visit Update 🇳🇵 (Day 3)

Scorpion Capital – Nepal Mission | Day 3 Highlights 🇳🇵

🔋 Hydropower & Green Energy: Dialogues on cross-border hydro grids & Green Energy Fund launch

🌿 Agro & Organic: Investment push in sustainable farming & agri-fintech

🎬 Tourism & Entertainment: PPP tie-ups in resorts, spiritual tourism & film destinations

🕉️ Spiritual Stop: Team visit to Pashupatinath Temple for divine blessings

🤝 Focus: Mobilising FDI into Nepal’s green & inclusive economy 🌱

Team Scorpion Capital – Nepal Visit Update 🇳🇵 (Day 2)

We’re pleased to share that Day 2 of the Nepal Investors Conclave concluded with excellent outcomes and strategic engagements.

✅ Successful meetings held with leading promoters from:

✈️ Aviation Group – for cross-border airline & MRO collaborations

💻 IT & AI/ML Sector – fostering next-gen technology partnerships

🌾 Agro Industry – value chain investment & processing tie-ups

🏨 Hospitality Sector – luxury & wellness hotel development

🤝 Additionally, a high-level meeting was conducted with the CEO of the Investment Board of Nepal (IBN) at their headquarters in Nepal Parliament Annexe, Kathmandu.

Key discussions focused on:

- Cross-border investments

- Trade finance solutions

- FDI in infrastructure, tourism, film city & strategic sectors